There are a number of proven strategies to help you better manage your mortgage in a rising rate environment. There is little doubt that we’re now firmly in an upward rate cycle. The Reserve Bank of Australia (RBA) has already pushed rates up tree times and all rhetoric coming from the bank – supported by current economic data – would indicate that there’s going to be a number of additional hikes over the early part of this year.

Rate increases for borrowers on a variable rate mortgage will translate into higher mortgage repayments. While borrowers should have factored in a number of interest rate hikes when taking out their mortgages, the reality is that some borrowers will still struggle with higher repayments. But if you’re worried about the impact of higher rates, don’t despair – there are a number of tactics you can employ to help you better manage your mortgage.

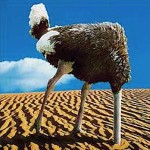

Don’t stick your head in the sand. If you think your going to struggle with increased mortgage repayments take immediate action. First up undertake a solid assessment of your current finances. This means creating, or reviewing your household budget. Your budget should include all household costs over the course of a month- including food, mortgage repayments, utilities, entertainment as well as allocating the monthly installment of yearly costs, like school fees, car registration and insurance. Once you’ve accurately determined your monthly outlay you’ll be able to assess where you can realistically tighten up your spending. Repayments can spiral out of control should you try to ignore them, making it harder to rectify the situation in the future.

SEEK EXPERT HELP

If you think your still going to struggle to meet your repayments, even after trimming back your budget, your broker should be able to help. Today, most lenders would sooner work with the borrower when they run into difficulties with their repayments than take the hard line. As long as your honest and address the problem early, there’s every chance that your broker and your lender will be able to help you find a solution. One such approach is to switch to an interest-only option for a period of time- thus reducing the monthly payments. While this means that you won’t reduce the principle of your mortgage during this period, it is an effective strategy to minimize your repayments while you seek other alternatives to meet your commitments. Remember, if you think your going to struggle with increased repayments act now to avoid problems in the future. Contact us today, on 49722081 if you need help.

If you’ve got a gap between your household expenses and monthly salary start to channel additional funds into savings. A slush fund can help buffer against future rate rises or other unexpected costs- such as medical bills or unplanned emergency renovations. Try to aim to save at least 20 per cent of your monthly take home pay or even 10 per cent should funds be tight. Even if you don’t need to draw on these funds to meet increased mortgage repayments they’ll make for good savings, which can be channelled into your mortgage or even used for a much needed holiday.